florida estate tax limit

Sales tax dealers must collect both discretionary sales surtax and the state sales tax from the purchaser at the time of sale and remit the taxes to the Florida Department of Revenue. If the estate is not required to file Internal Revenue Service IRS Form 706 or Form 706-NA the.

Determining Illinois Estate Tax Rate Is Surprisingly Difficult

The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that.

. County municipal and independent special district property tax levies have been subject to the maximum millage limitations in s. When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent the property owner may be eligible to receive a homestead. Florida Property Tax Valuation and Income Limitation Rates see s.

On average the Florida property tax rate sits at 083 with homeowners paying an average of 2035 in property taxes every year. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The Portability Amendment literally made that tax savings portable so you can now transfer up to 500000 of your accrued Save Our Homes benefit to your new home.

Ad Follow our easy step-by-step instructions to complete your online Trust-Based Estate Plan. TAMPA -- The 2022 limit for assessment value increases of Homestead property has been released by the Florida. The 2021 tax year limit or the amount limit in 2022 after adjusting for inflation is 1206 million up from 117 million in 2021.

Get Access to the Largest Online Library of Legal Forms for Any State. Ad Access Tax Forms. Counties in Florida collect an average of 097 of a propertys assesed fair.

As of 2019 if a person who dies leaves behind an estate that exceeds 114 million. A Florida Property Tax Limit Amendment 3 initiative did not appear on the November 2 2010 ballot as a legislatively referred constitutional amendment. No Florida estate tax is due for decedents who died on or after January 1 2005.

Complete Edit or Print Tax Forms Instantly. Florida Homestead Exemption You can qualify for the homestead exemption on your permanent primary residence. You pay no property tax including school district taxes on the first 25000 of your homes value.

PROPERTY TAX BENEFITS FOR PERSONS 65 OR OLDER. The save our homes property tax cap is an amendment to the florida constitution that limits the annual increase in the tax assessment of homestead property to a maximum of. Chat With A Trust Will Specialist.

The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. 1 Any funds after that will be taxed as they pass. The Florida Homestead Exemption provides multiple savings.

Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. 200065 5 FS since 2007. A Florida Property Tax Limit Amendment 3 initiative did not appear on the November 2 2010 ballot as a legislatively referred constitutional amendment.

Built By Attorneys Customized By You. This is comparatively lower than the national average of. There are two levels of the homestead exemption.

Does Florida Have An Inheritance Tax Alper Law

Creating Racially And Economically Equitable Tax Policy In The South Itep

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

Considering A Move To Florida What You Need To Know About Changing Domicile Pnc Insights

How To Apply For An Estate Ein Or Tin Online 9 Step Guide

Generation Skipping Trust Gst What It Is And How It Works

State By State Estate And Inheritance Tax Rates Everplans

Does Florida Have An Inheritance Tax Doane And Doane P A

How Can I Avoid The Massachusetts Estate Tax Heritage Law Center

How Do State Estate And Inheritance Taxes Work Tax Policy Center

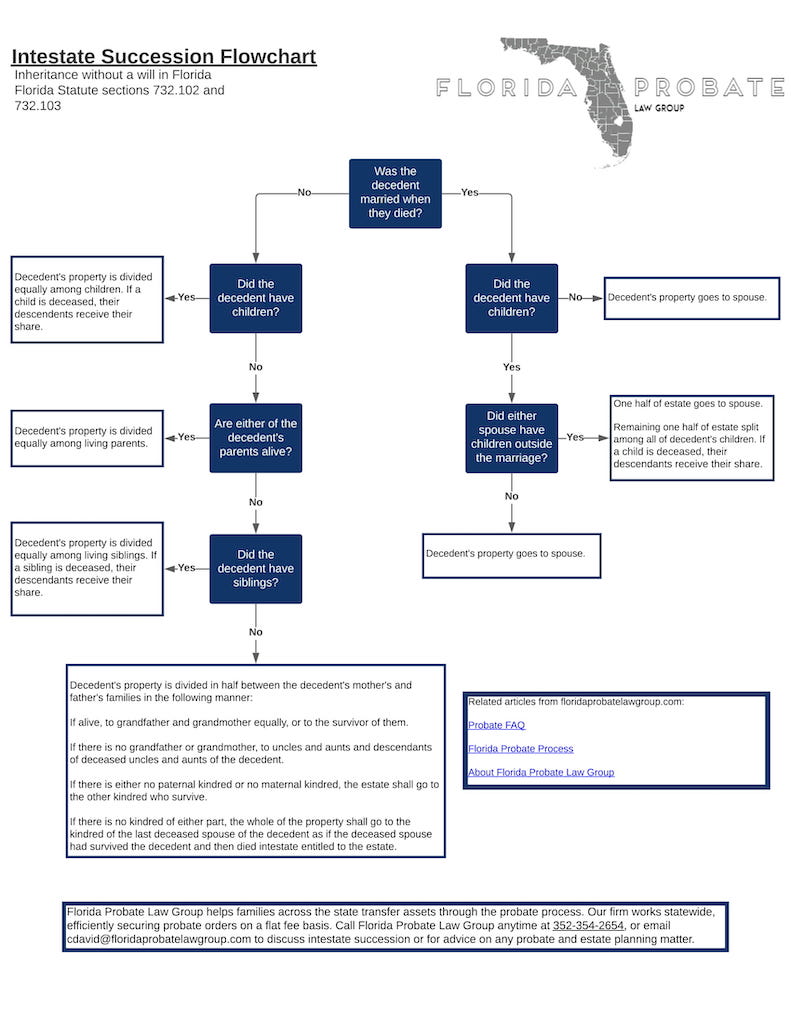

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

The Florida Homestead Exemption Explained Kin Insurance

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

Do Inheritance And Estate Taxes Apply In Florida

The Florida Homestead Exemption Explained Kin Insurance

Michigan Inheritance Tax Explained Rochester Law Center

The Complete Guide To Florida Probate 2022 Florida Probate Blog January 2 2022

States With No Estate Tax Or Inheritance Tax Plan Where You Die